What is DigiLocker?

DigiLocker is an online service provided by Ministry of Electronics and IT, Government of India under its Digital India initiative. DigiLocker provides an account in cloud to every Indian citizen to access authentic documents/certificates such as driving license, vehicle registration, academic mark list in digital format from the original issuers of these certificates. It also provides 1GB storage space to each account to upload scanned copies of legacy documents.

How can I use Digi Locker?

To use DigiLocker you have an Aadhaar card number and a mobile number. Your Mobile number must be link with Aadhaar card. One OTP is required to register with DigiLocker.

1. Open DigiLocker https://digilocker.gov.in/ and click on Sign up. One window will open, Enter your Aadhaar card number and click on Continue.

2. One window will open with your Aadhaar card number and Enter 6 digit OTP as you received you mobile number which lick with Aadhaar card and click on Continue.

3. Now Set 6 Digit PIN number and click on submit. It will require in future, now registration process is complete.

4. Now Login to DigiLocker account. Enter Mobile No/Aadhaar No and click on Login

5. Again enter 6 digit OTP as you received to your mobile and click on continue.

6. Enter 6 Digit PIN number as you set in registration time and click on submit.

7. You are now in DigiLocker account Dashboard section. In DigLocker have 156 Central and State Govt. Document issuer and 45 organization are pending.

8. Now click Documents. Here it is showing 3 issued documents.

Now click on download PDF Document will from Issuer Website. Any change of document it will reflect. You can also upload any other document from other source.

How to Get Documents??

Example:

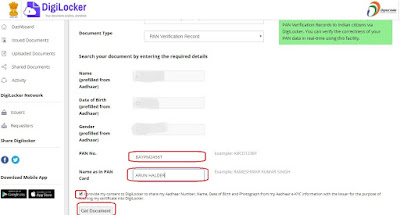

PAN document of Income Tax Department. Enter PAN card number, Name as printed in Pan card and click on Get Document. It will fetch document from Income Tax Department and will show in issued section.

No comments:

Post a Comment